- Landlords are entitled to a 10% allowance if they settle their bill by a given deadline. However, renters and owner-occupiers can also secure lower rates for prompt payments – albeit with only a 4% relief.

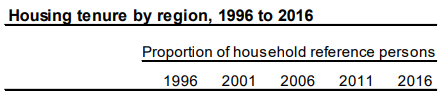

- In 1996, only 5% of homes in NI were privately rented.

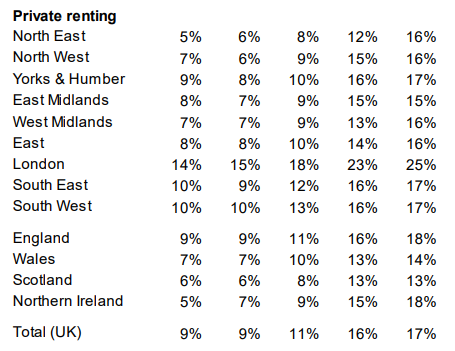

- Today, that figure is around 13%, which is indeed the same as Housing Executive and housing association homes combined.

On 25 October in an article for the Belfast Telegraph, journalist and policy expert Paul Gosling claimed that:

“As landlords, we are given a discount on our rates bill. While tenants and owner occupiers may be paying their rates in full, landlords are given a 10% rebate, providing they pay their bills on time.

“This benevolent attitude to landlords is a policy with an outcome. Back in 1996, there was almost no private rental sector in NI.

“Today, according to the official NI figures, it accounts for 13% of housing — the same as the Housing Executive and housing associations combined.”

This amounts to two separate claims, both of which are backed by evidence.

Landlords who pay rates bills by a set deadline receive a 10% allowance off their total bill. Owner-occupiers and renters who are responsible for paying rates can also receive a reduction in their bill, albeit this discount (4%) is lower than the help for landlords.

Figures from the House of Commons Library indicate that 5% of NI households lived in privately-rented accommodation in 1996.

Official figures from the Department of Communities indicate that 13% of homes are now privately rented, compared with 9% under Housing Executive control and 4% administered by housing associations.

FactCheckNI contact Mr Gosling about his claim, and he pointed us towards various official data published by the House of Commons Library and various Stormont departments.

- Landlords allowance

Mr Gosling suggests that “while tenants and owner occupiers may” pay full rates, landlords can get a 10% rebate provided they settle their bills in time.

Landlords are entitled to a 10% allowance on their rates bill, provided they pay before a given deadline.. If they miss the deadline, landlords must pay the full amount.

It’s also possible that tenants or owner occupiers will have to pay their rates in full.

On that basis, this part of Mr Gosling’s claim is accurate. However, that’s not the whole story, because tenants/owner-occupiers can also lower their bills if they meet certain conditions.

In general, domestic ratepayers receive a 4% discount on their rates if they pay in full by a given deadline.

There is further help with bills for pensioners or people relying on social security.

- Distinctions

FactCheckNI asked the Department of Finance why the two general reductions in payments are significantly different, 10% compared with 4%. A departmental spokesperson said:

“There are two separate reliefs to note. One is a discount; one is an allowance.

“In the domestic rating sector in Northern Ireland, a 4% discount is available for annual rates payments, if paid in full on or before the date stipulated on the rate bill. For owner-occupiers and those in rented for renters (when they are responsible for payments), this discount is 4%.

“Landlords who are liable to pay rates to Land and Property Services (LPS) will receive a 10% landlord allowance on the total amount due if the bill is paid in full by 30 September or the date stipulated on the rate bill if issued after this date. Vacant properties that are not subject to Article 21 agent status can receive a 4% discount on annual rates if paid in full by the date stipulated on the rate bill.

“The two reliefs noted are not connected. Landlord Allowance recognises the landlords liability for all properties within their portfolio by making one payment for all rates due. The person responsible for paying rates on domestic rented properties depends on the property’s capital value, or if it’s a house of multiple occupation.”

An explanation of NI’s current rates system is available here, while DoF also highlighted that it is currently carrying out a public consultation on a range of rates reliefs and allowances. That consultation is open until 24 February.

- Growth

Mr Gosling’s second claim centred on significant growth in the private rental sector in NI over the past 30 years – from negligible size in 1996 to 13% of all homes today, roughly the same as the Housing Executive and all housing associations combined.

Home ownership & renting: demographics, a 2017 briefing paper from the House of Commons Library, states that 5% of NI households were privately renting in 1996.

Figure 1 – source: House of Commons Library paper Home ownership and demographics (2017)

The Northern Ireland Housing Statistics 2021-22 – the latest housing figures from the Department for Communities (DfC) at the time the claim was made – state that around 13% of NI homes were privately rented in 2021-22, while 9% were Housing Executive homes and 4% were under the administration of a housing association.

Figure 2 – source: Department for Communities figures

Last month, DfC published newer housing statistics, covering 2022-23, but these were not publicly available when Mr Gosling wrote his article. These latest statistics say that “13% of households were privately rented and 4% were rented from housing associations. NIHE rented properties made up 10% of households [a slight increase]”.

While Mr Gosling’s wording of there being “almost no private rental sector” in 1996 perhaps understates the 5% of all homes that were in that sector, his choice of words is not totally inaccurate – and, more to the point, it is beyond doubt that the private rental sector has grown significantly since then.

Meanwhile, the specific figures cited by Mr Gosling are all supported by evidence.

- Just one more thing

The fact check is over, but readers might have noticed that, according to the Commons Library paper we cited above, around 18% of NI’s homes were privately rented in 2016.

Does this indicate that there has been a decrease in the proportion of homes that are privately rented in the past seven or eight years (to 13%). Perhaps, but not necessarily.

A few things to remember:

- Statistical comparisons made over long periods of time – this fact check covers almost three decades – are not always perfectly clean.

- Different methodologies can be used to measure ostensibly the same thing, with differing results.

We asked DfC for figures relating to 2015-16 and 2016-17 – they are no longer available on the DfC website – and the NI Housing Statistics provided for those years indicate that 17% and 16% of households, respectively, were privately rented.

Does that mean there has been a decrease? Perhaps. However, DfC’s figures for 2021-22 (cited in the fact check above) included the following caveat:

“Please note that the Continuous Household Survey methodology changed in 2020-21 and 2021-22 in response to the COVID-19 pandemic. As a result, caution should be taken in reaching any conclusions based on 2020-21 and 2021-22 data and comparisons with previous years.”

It pays to remember that even the best-available evidence isn’t necessarily perfect.