This claim is accurate. In 2019, the ratio of the estimated total value of Northern Ireland purchases from Great Britain (£13.4bn) to purchases from Ireland (£3.0bn) was 4.5:1. The ratio has been similar since 2013. However, the figures may not tell the full story as they do not provide information on transport/shipping routes or the country of origin of any goods purchased.

On 14 January 2021, the DUP published a document, “7 reasons the Irish Sea border must go”, in order to “[highlight] the impact of the Protocol on Northern Ireland and the wider United Kingdom”.

One of the claims in the document is “Northern Ireland purchases from Great Britain (£13.4bn) are four times more valuable than of Ireland (£3.0bn).”

The DUP told FactCheckNI that the figures were sourced from a Northern Ireland Statistics and Research Agency (NISRA) publication on the Broad Economy Sales and Export Statistics (BESES) and a slide that shows “Total Value of NI Purchases and Imports by Origin 2018–2019”.

BESES is an experimental annual measure of local businesses’ sales and purchases to markets inside and outside Northern Ireland. Traders in the public sector, finance, and agriculture sectors are not captured by BESES; ther exclusions and further information on the strengths and limitations is available in the BESES reference guide. The statistics are used by the Department for the Economy (DfE), the Department of Agriculture Environment and Rural Affairs (DAERA), the Department for Exiting the EU (DExEU), and other economists and policy makers.

NISRA breaks down sales and purchases under the following definitions.

Figure 1. Overview of definitions

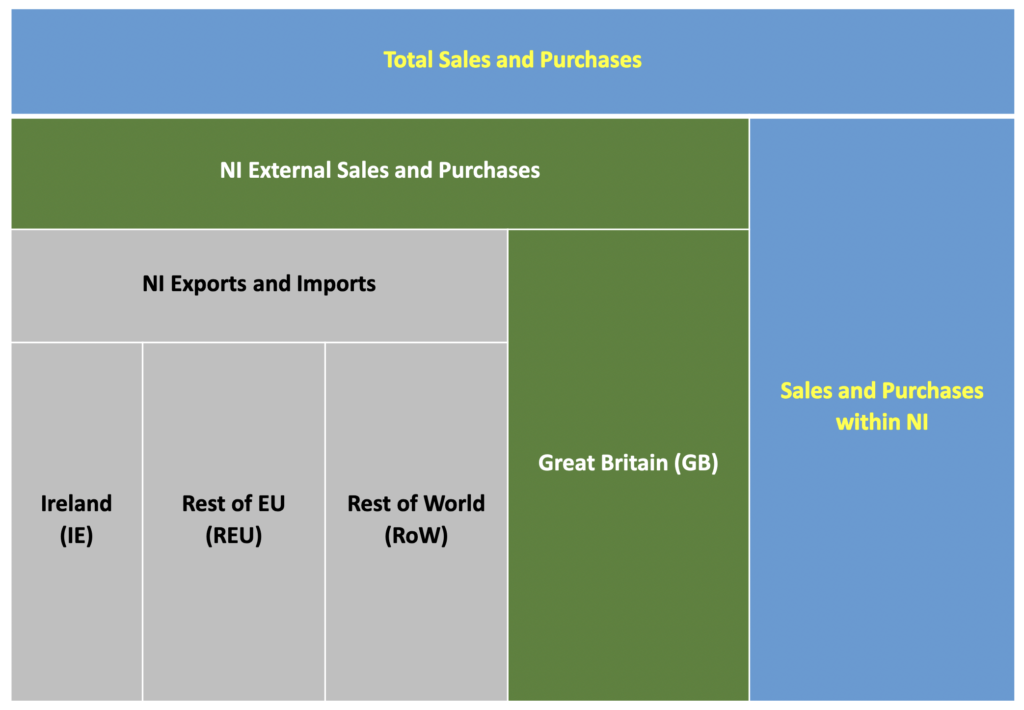

The NISRA BESES bulletin covering purchases within Northern Ireland and from other places is relevant to this claim. Key points include total purchases (goods and services) by companies in Northern Ireland in 2019 were estimated to be worth £46.4bn, and purchases within Northern Ireland represent 54% of all purchases made.

For 2019 purchases made by Northern Ireland companies, the value of purchases from Great Britain (£13.4bn) is 4.5 times greater than the value of imported goods and services from Ireland (£2.9bn); the claim is accurate. The ratio has been similar between these two markets since 2013.

Key points of this bulletin are illustrated in the following graphic.

Figure 2. Purchases and imports of goods and services by Northern Ireland companies, by trade partner (2019) (£billions)

NISRA notes that BESES data does not provide information on:

- whether goods purchased are final products or are intermediate goods to be used in a further production process;

- transport/shipping routes;

- the country of origin of any goods purchased.

In regards to the country of origin, NISRA explains that even if a seller in Great Britain originally bought a good from outside the UK, BESES will still record it as a Northern Ireland purchase from Great Britain. Therefore, NISRA adds, goods purchased from Great Britain could have been produced outside the UK and so the supply of goods from Great Britain to Northern Ireland could be impacted post-Brexit. That is, post-Brexit changes could impact not only the direct supply of goods from Great Britain to Northern Ireland, but also from the EU to Great Britain.

Sales versus purchases

BESES figures are also available for sales by companies in Northern Ireland. (Statistics for 2020 results are also available, but we’ll look at 2019 data here for the sake of comparison.) Key points include total sales by companies in Northern Ireland in 2019 were estimated to be worth £71.9bn, and sales within Northern Ireland represent about 68% of all sales.

For 2019 sales by Northern Ireland companies, the value of sales to Great Britain (£11.3bn) is 2.5 times greater than the value of exported goods and services to Ireland (£4.5bn). The data show a similar ratio between these two markets since 2011.

Summary

In 2019, the ratio of the estimated total value of Northern Ireland purchases from Great Britain (£13.4bn) to purchases from Ireland (£3.0bn) was 4.5:1. The ratio has been similar since 2013.

For 2019 sales by Northern Ireland companies, the value of sales to Great Britain (£11.3bn) is 2.5 times greater than the value of exported goods and services to Ireland (£4.5bn). This ratio has been similar since 2011.

BESES data does not provide information on transport/shipping routes or the country of origin of any goods purchased; post-Brexit can impact not only the direct supply of goods from Great Britain to Northern Ireland, but also from the EU to Great Britain.