- Reputable information exists that supports this claim

- However, this claim involves comparisons between different accumulations of estimates rather than easily-calculated figures

- The individual wealth of billionaires can fluctuate significantly day by day, while measuring population wealth is itself tricky

On January 16, Oxfam International published a new report – Survival of the Richest – which looks at the changing distribution patterns of wealth around the world.

To publicise the report, Oxfam Ireland issued a press release which claimed:

“Ireland’s two richest people have more wealth – €15 billion – than half the Irish population who have €10.3 billion.”

On the same day, the claim was repeated on RTE News and by a user on Twitter, who said:

“The two richest people in Ireland now have more wealth then [sic] the bottom 50% of the population combined.”

Oxfam’s measurements involve well-sourced data, and found that the least-well-off half of the Republic of Ireland holds around €10.3 billion while the richest two people in the population are worth around €15bn.

However, calculating these figures relies on both estimates and analyses, rather than looking at two ironclad numbers side by side. Other calculations which are similarly robust could lead to different conclusions.

Simple?

This claim centres on a fundamentally simple calculation: comparing two amounts of money and seeing which is larger.

Where it gets complicated is in how both of those figures are calculated.

Billionaires

A person’s net wealth is usually measured as the sum value of their financial and non-financial assets, minus any debt.

To calculate the wealth of the two richest people in Ireland, Oxfam used the Forbes Real-Time Billionaires list.

Wealth changes over time. The organisation’s calculation was made on 30 November last year. On that day, the two richest people in Ireland were brother John and Patrick Collison, founders of FinTech company Stripe. They were valued at $8.1bn each.

Combined, this makes $16.2bn – which equates to €15.066bn (at the €0.93 = $1 exchange rate Oxfam used in its report, which was the exchange rate on 30 November) or approximately €15bn.

Population

Calculating population wealth is based on a series of estimates and further calculations.

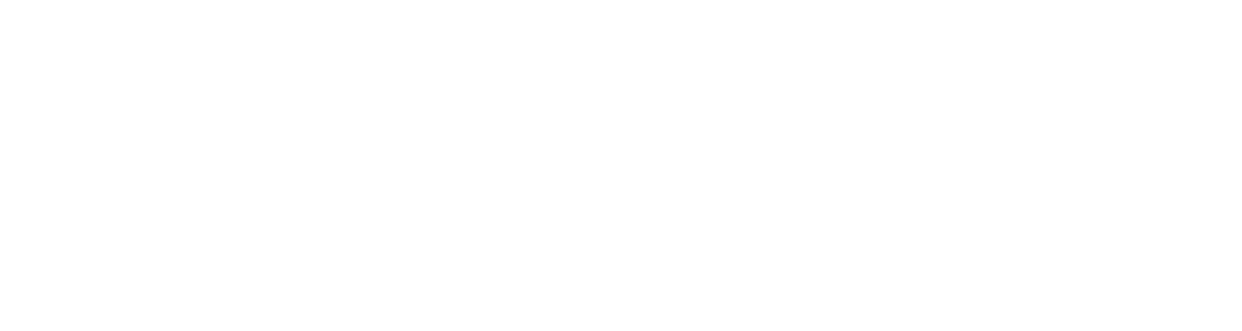

Oxfam calculated the wealth of the “half the Irish population who have 10.3 billion” using the Credit Suisse Global Wealth Report Data Book 2022. The total wealth in Ireland was valued at $920billion (based on 2021 figures inflated to November 2022 price levels using the US Consumer Price Index [CPI], to align it with the time that the Forbes billionaire data was taken).

Figures 1 – SOURCE: Credit Suisse Global Wealth Databook 2022 p.22

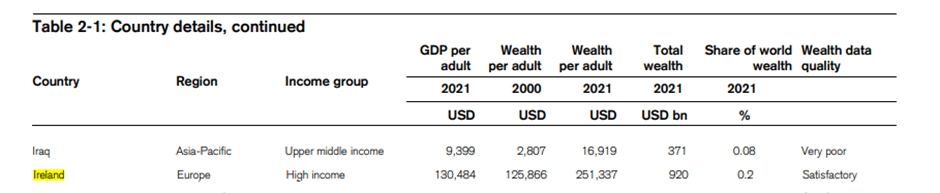

Using the same report, Oxfam used wealth decile figures to calculate the wealth share of the bottom 50% of individuals in Ireland – which cumulatively totals at 1.2%.

Figure 2 – SOURCE: Credit Suisse Global Wealth Databook 2022 p.140

The bottom five deciles hold -2.8% (i.e. debts outweigh assets for this group), 0.0%, 0.2%, 1.0% and 2.8% of the individual wealth in Ireland, respectively.

Adding these together indicates that the least-well-off half of Ireland holds 1.2% of all wealth in the country. 1.2% of $920bn is $11.04bn.

Using the given exchange rate of €0.93 to the dollar, $11.04bn equates to €10,335,648,000 – or roughly €10.34bn.

Comparison

Oxfams’ calculations indicate that, at the relevant time, the two richest people in Ireland we worth around €15bn while the poorest 50% of the country held around €10.3bn.

Based on this evidence, the claim is accurate.

However, it’s important to note that calculations like this come with several caveats.

Complications in population wealth

Measuring population wealth is based on estimates – and different models or methods of calculations may result in significantly different outcomes. Assessing the wealth of different groups can face hurdles including poor response rates to surveys, and under-reporting of assets from wealthy individuals.

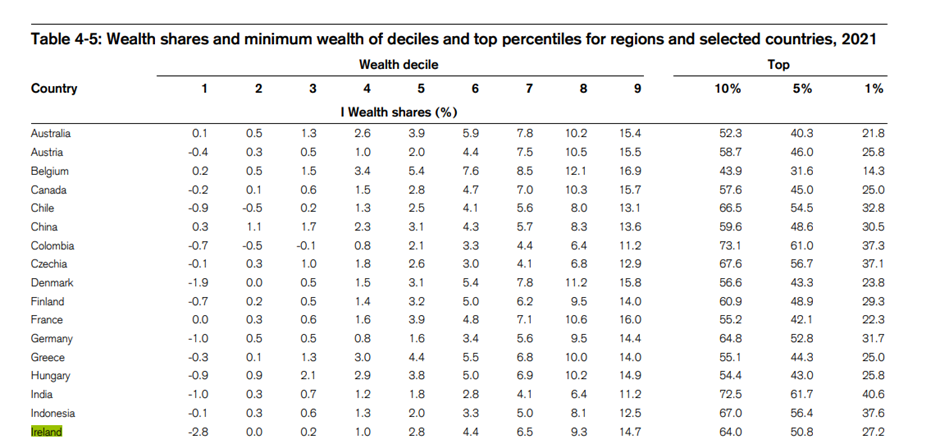

The Central Bank of Ireland is developing new data on Distributional Wealth Accounts (DWA) as part of a collaboration with the national central banks of 18 European countries, all led by the European Central Bank.

The DWA combines distributional information from the Household Finance and Consumption Survey (HFCS) in Europe with national account statistics (such as the Quarterly Financial Accounts, non-financial assets statistics and information from rich lists).

In a ‘Behind the Data’ article published in November 2022, the Central Bank placed the total household net wealth in the Republic of Ireland at €1.007bn. The DWA data states that between 2013 to 2022, the share of the net wealth of the bottom 50% increased from 2% to 7%. According to these DWA figures, the wealth share of the bottom 50% households is therefore €70,490,000,000 in November 2022.

That figure would not support Oxfam’s claim.

However, the methodology details that will allow full scrutiny of this figure are not yet available to the public. FactCheckNI requested this information but the request was declined.

From what we do know, there are two differences of note between the Oxfam and Central Bank methodologies:

- Oxfam measures wealth of individual people and the Central Bank figure measures the wealth of households.

- Both Credit Suisse and the Central bank used the Euro Household Finance and Consumption Survey but the Central Bank also used Quarterly Financial Accounts (QFA), which were more up to date, and unnamed non-financial assets statistics.

According to the Central Bank’s QFA release, the wealth of households in Ireland reached a record high in Q3 2022 of €1.053bn, primarily due to the rising cost of houses in Ireland reaching an all-time high of €700bn.

Despite not indicating wealth disparity at exactly the same level as the Oxfam calculations, according to the Central Bank, the top 10% of households accounted for 48% of the net wealth growth since 2013 while the bottom 50% accounted for only 12% of that rise.

Figure 3 – SOURCE: Central Bank of Ireland DWA Behind the Data.

Complications in individual wealth

Measuring the wealth of the superrich is also tricky. This too relies on estimates, to a degree – as not all assets (or debts) will be clearly available in the public domain.

The wealth of billionaires can also fluctuate significantly. The Forbes World’s Billionaires List 2022, published in April 2022, set the Collison brothers’ wealth at $9.5bn apiece, so a combined $19bn which, at the €0.93 exchange rate, equates to €17.8bn.

At the time of writing [28 February], the Forbes list calculates their wealth as $6.9bn each, for a combined $13.8bn, or €12.8bn.

Verdict

While Oxfam’s claim is backed up by evidence, that evidence it relies on is both based on compounded estimates and can be subject to rapid change.

New information and/or methods of analysis that appear in future could also conflict with (or further support) Oxfam’s claim – such as the DWA data being compiled by the Central Bank of Ireland.